CLO

Cashflow Profile

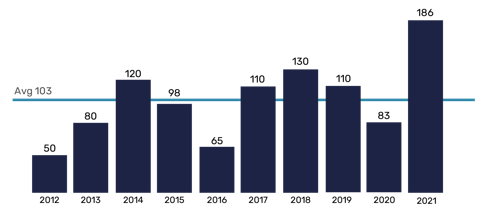

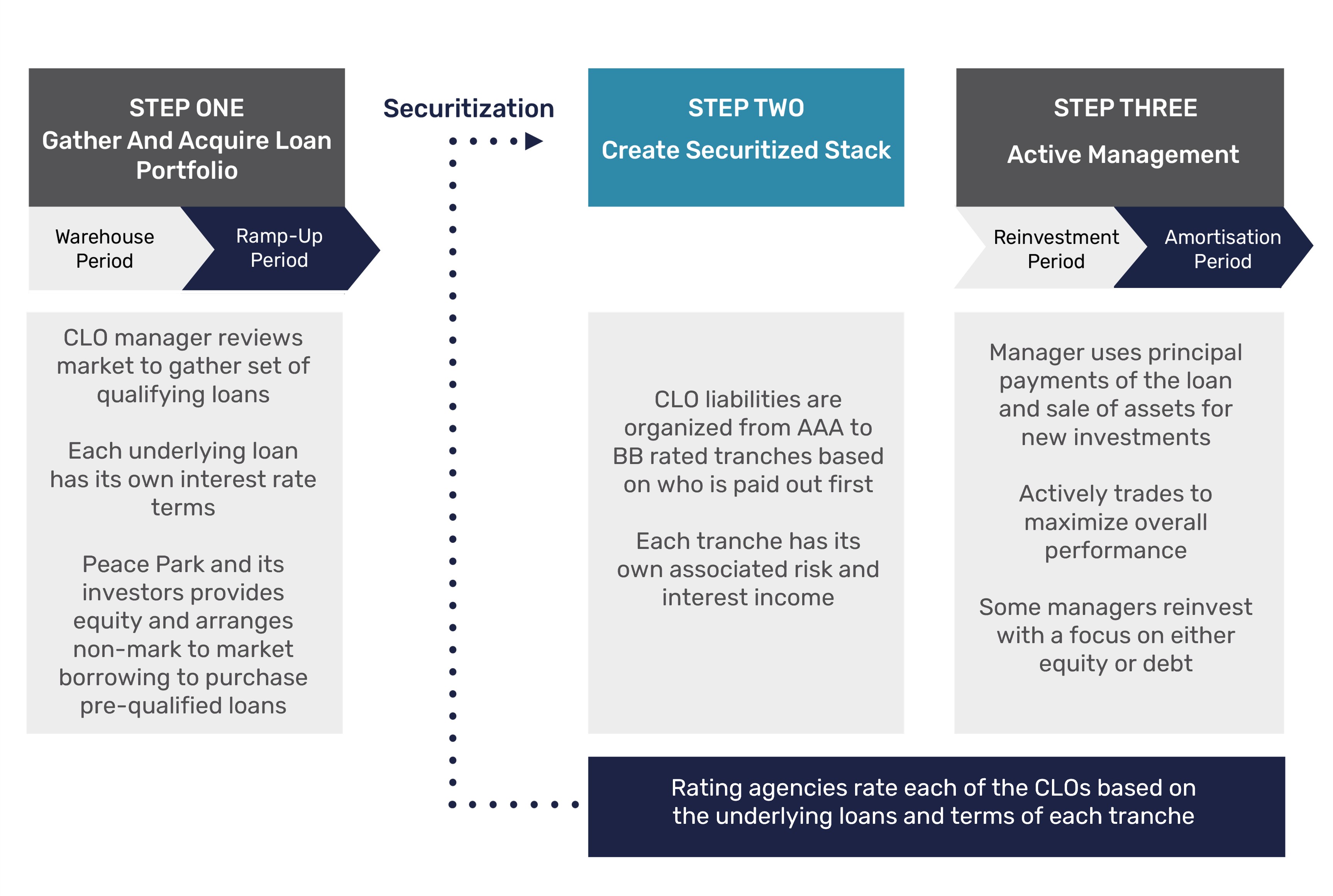

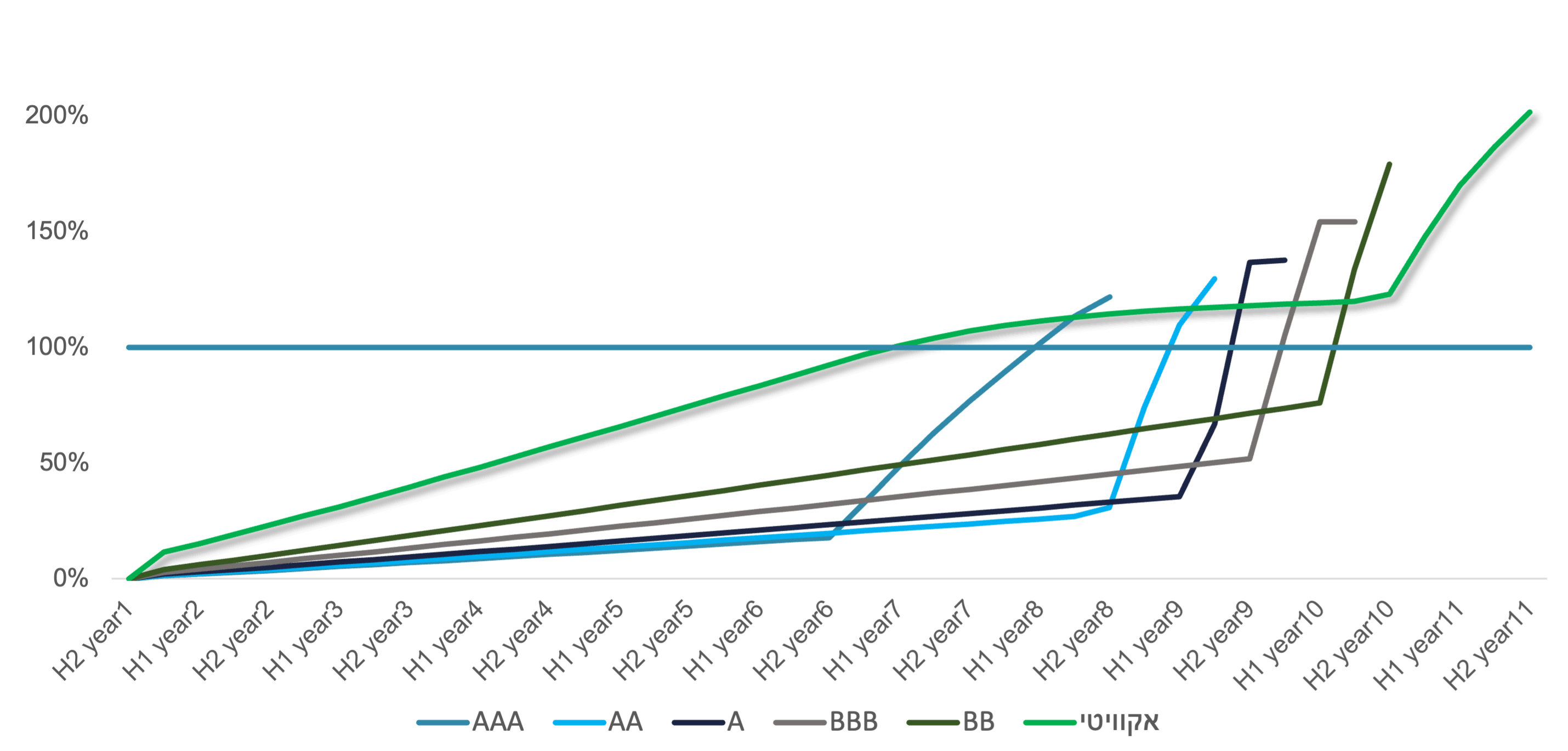

Cash flow structure in a typical CLO allows the equity layer to return almost the entire amount of the original investment to the debt holders before the start of the fund payments.

Cumulative Flow Rate In The Tranches Out Of The Total Investment In Each Tranche

Key Characteristics

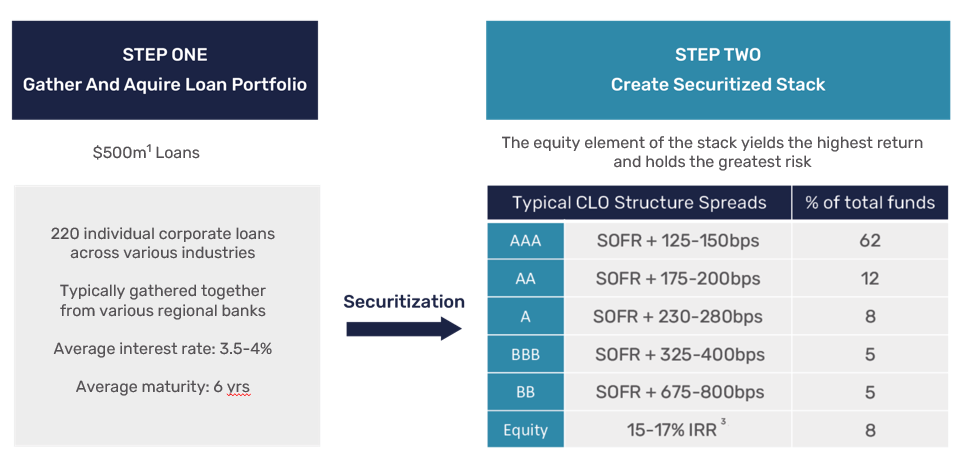

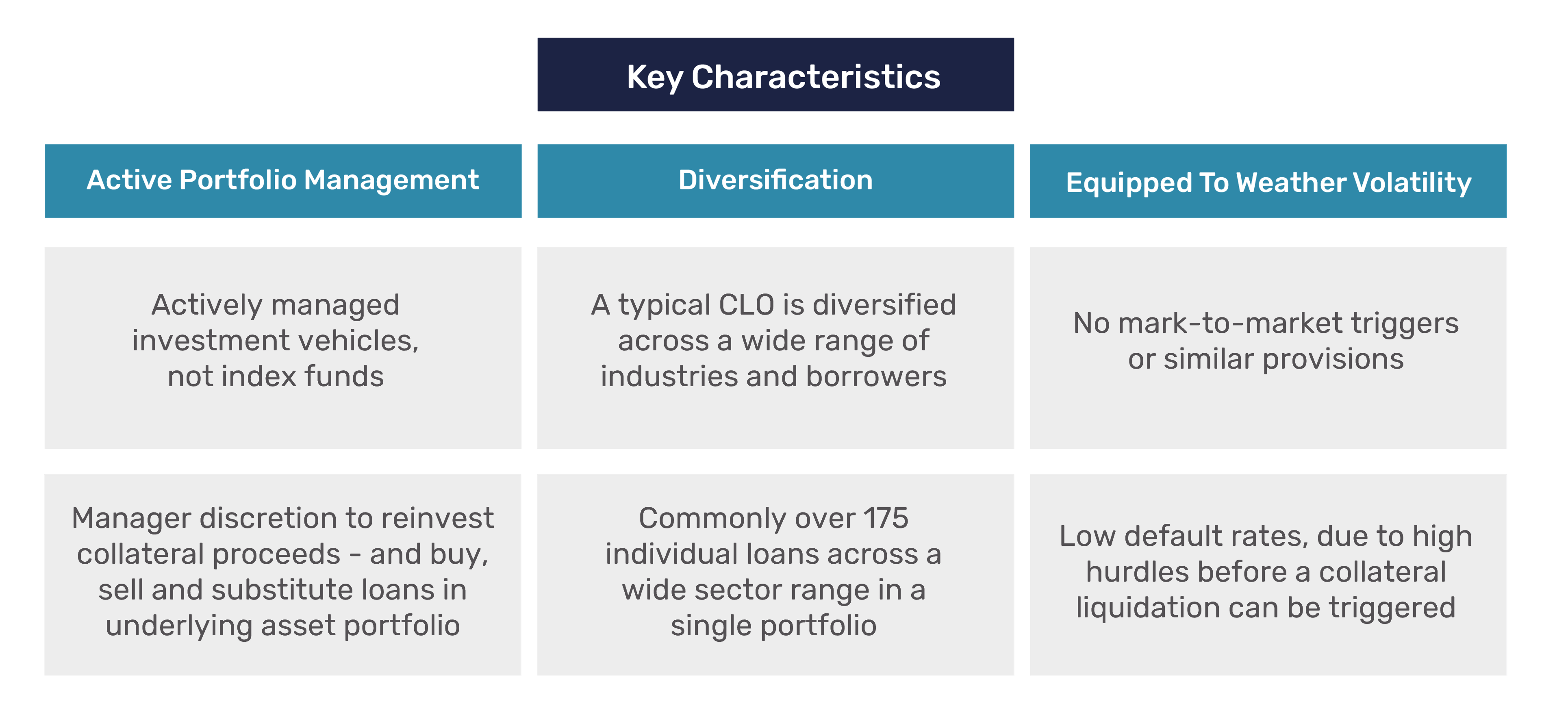

CLOs are securitizations backed by a diverse portfolio of senior secured loans to mid-large US businesses that are rated below investment grade.

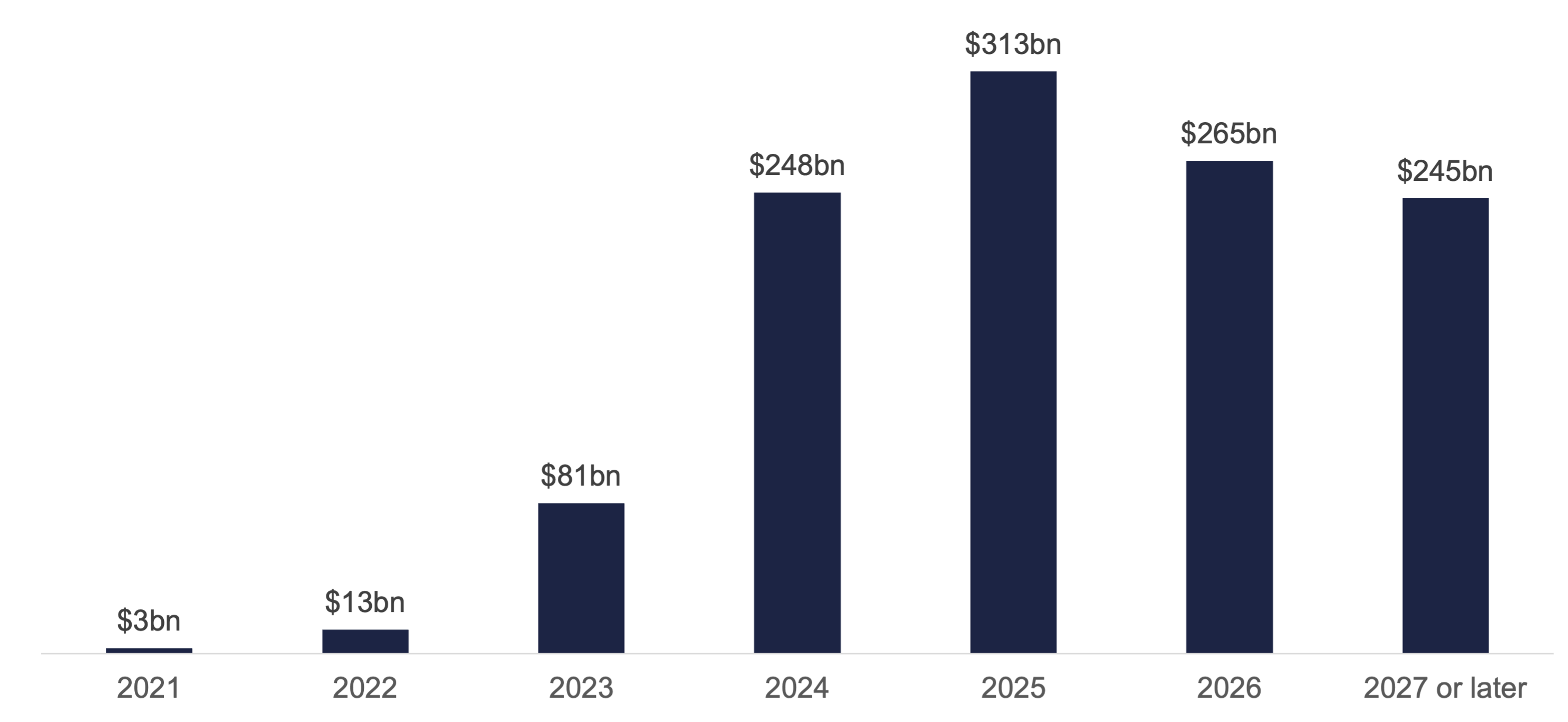

Established And

Growing Market

CLO investments are attracting a growing number of investors and becoming an increasingly common component of an investment portfolio.

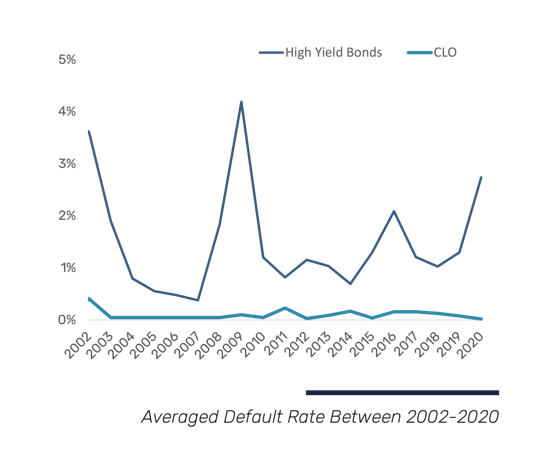

Relatively Low

Default Rates

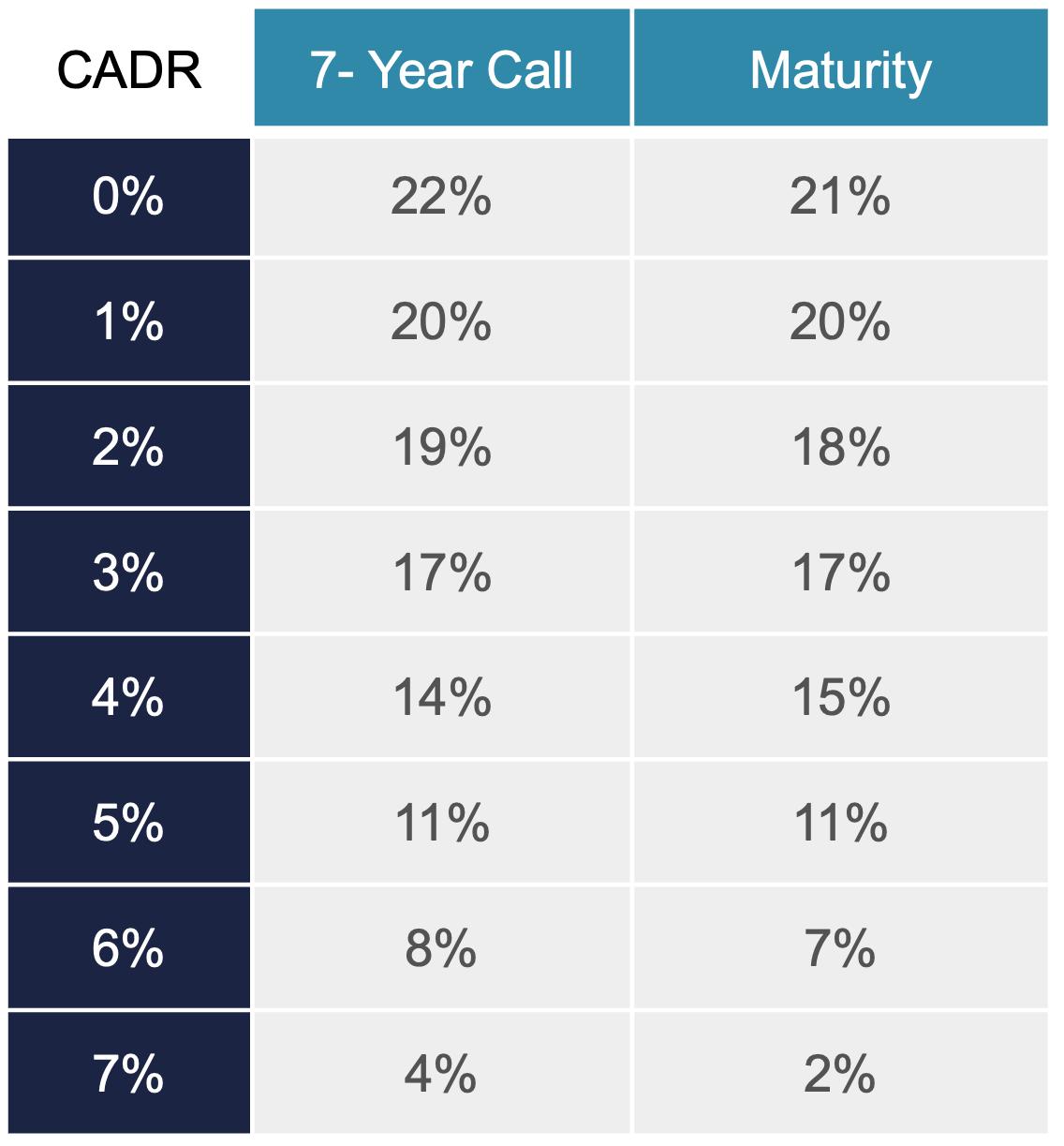

Loan default rates within US CLO tranches have been well below those of high yield bonds with only 0.03% of CLOs defaulting from 1996 to 2020. Control terms in which Peace Park executes transactions result in significant returns. For the equity layer to result in a negative return, very high default rates are required.

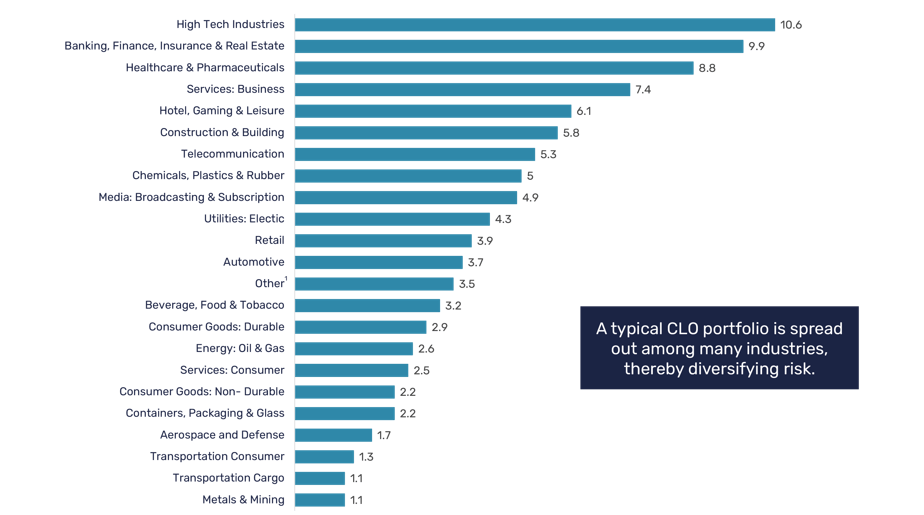

Diversified

Loan Portfolios

Meant to protect investors from risks associated with specific industry “meltdowns”.

Longer Term

Maturities

Longer CLO debt maturities (legal maturity c.13 yrs, average duration 6-7 yrs) and shorter underlying loan maturities (c.6 yrs, duration 3-4 yrs) remove the asset-liability mismatch that forces liquidation in down-cycles. Prepayments of underlying loans force reinvestment into dislocated and cheap markets, creating upside opportunities when markets recover.